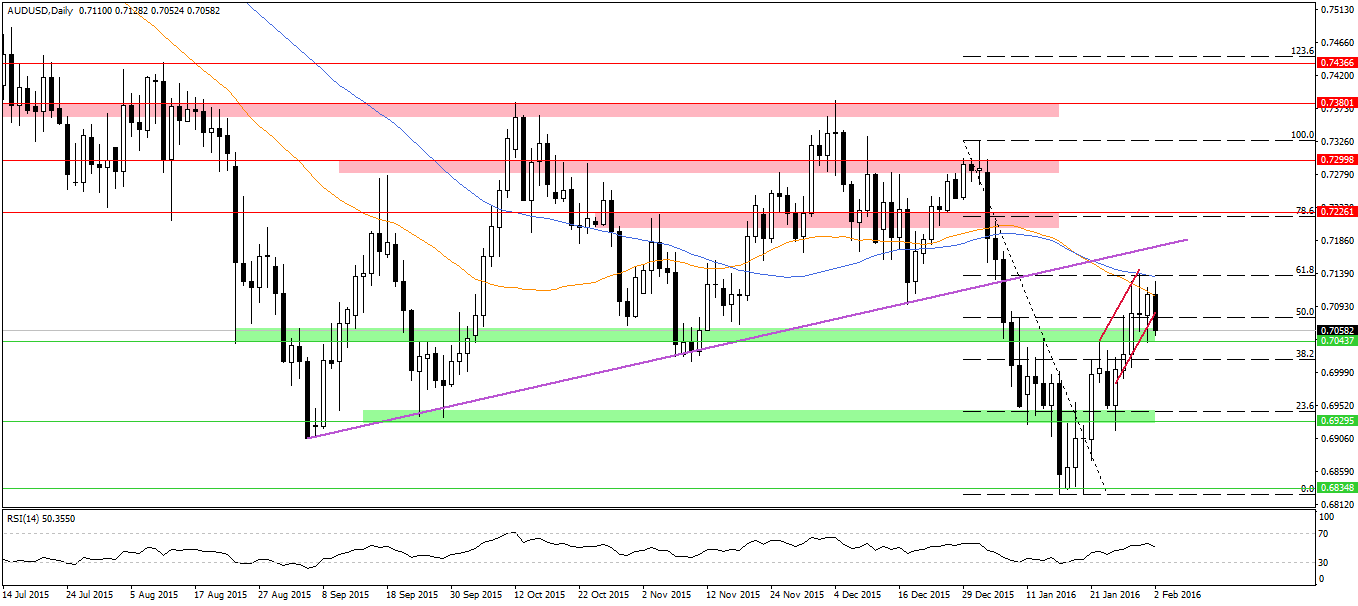

In spite of the fact, that the Reserve Bank of Australia left interest rates unchanged and delivered quite hawkish statement the Australian dollar is on the back foot thus far. The Bank underlined furterh possibility of monetary easing if needed, albeit it pointed out the AUD has been adjusting to substantial declines in commodity prices. Furthermore, it stressed that recent financial market turmoil may lead up to weaker growth, while Chinese concerns are relatively balanced (in the statement we may have found China’s growth has continued in moderate pace). Moreover, the RBA marked significant improvement in non-mining investements last year. As for prospect for inflation it pointed that it may stay low for some time (1-2 years). When it comes to labor market we could have read the Bank intends to wait for more data which should confirm or deny a sustained recovery in that area. All in all, such wordings sounded decisively less dovish as it was in prior cases. Nonetheless, traders on the AUD seem to have a little bit other thoughts. Ipso facto, the AUD is selling-off in still quite early European trading. Currently, on the daily time frame we may perceive bearish engulfing pattern is being formed, what may bode a reversal in corrective movement that has been proceeding uninterruptedly since 26th January. If the pair is able to break down a support zone at around 0,7040, it may go down even towards 0,6930. Additionaly, lack of demand above 0,71 is not accidental, at this place we may spot the two moving averages that provide decent support for the bears.

The RBA stayed put, the AUD tumbled

Powiadom mnie

Login

0 komentarzy